If you’re planning to invest in real estate, the first thing you’re going to learn about will be the demand and supply basis on which this market works. Even if you are a newbie to the real estate world, it is fundamental to grasp proper knowledge of the complexities of investment strategies. If you also have the same questions about the factors that should be considered, you’re in the right place.

This piece of writing will help you understand how to invest in real estate and the aspects that should be taken into consideration while investing. So, read along to know more.

To gain a deep understanding of the real estate market, let’s first discuss what real estate is. So, real estate is the property and the resources given in the property boundaries.

Now that we know what real estate is, the market is one that includes activities related to property sale and purchase. This industry is directed on a demand-and-supply basis, so, when the demand for an estate rises in comparison to its supply, the prices also rise, but when the supply gets higher than demand, prices tend to fall.

Now, we’ll be discussing the factors affecting this market, and how they can be utilized properly to make accurate investment-related decisions.

Your primary task should be thorough research. It will help you figure out the latest trends, and factors affecting property prices, and rental rates, and finally, determine the potential return on investment.

Just like real estate agents have a good knowledge of local economics, demographic flow, demand-and-supply, population growth, migration patterns affecting housing orders, and dynamics. It is important for you as well to be aware of these aspects to avoid any losses.

Also, determining whether it’s a buyer’s or seller’s market, keeping up with the supply dynamics too.

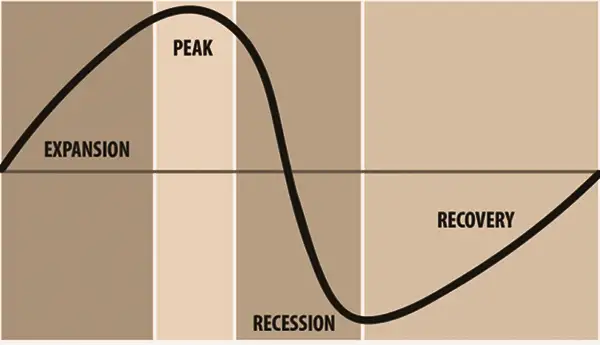

These markets move in a cycle of growth, elevation, drop, and recovery. Aspects like the cost of interest, fiscal growth, and government policies influence this cycle. When the growth phase starts, the sale gets high and property prices rise. While in the elevation phase, the market gets steady, with prices hiking slowly. During the drop period, selling and property prices fall, but the recovery period improves conditions, and prices start to accelerate again.

Figuring out the cycle helps in making accurate investment decisions. For example, purchasing possessions in a drop and improving phase can offer good value, and selling them during the growth phase can expand the margins for profits.

The key elements influencing the conditions are supply and demand. And income, employment opportunities, accessibility to credit, land constraints, retirees, upgrades, transportation, new structures, etc., are a few in the line of causes affecting demand and supply. For example, growth in jobs can increase the applications for housing, leading to price ups.

While on the supply market, construction costs, land availability, labor costs, zoning policies, etc., can impact the demands and supplies. A shortage of amount in a high-demand phase can lead to higher prices. Thoroughly inspecting these elements can assist you in assuming trends and making correct choices.

If you’re considering buying a home on a mortgage, high-interest rates can make you think about that again. Changes in these interest rates influence the person’s ability to make purchase-related decisions. It is highly witnessed in the market that when the RoI is higher, the demand for property eventually gets low.

Similarly, a drop in the RoI leads to higher demand for properties. So, it is always good to use a mortgage calculator to see how RoI affects purchase prices.

Government acts and legislations are other factors that influence the market. Tax credits, deductions, and subsidies are the most common ways of administration to boost demand and supply. Being attuned to governmental regulations can help you in determining the behavior of the industry.

The overall health of the economy also plays a vital role as an indicator to provide better market insights. Growth Domestic Product (GDP), unemployment data, interest rates, etc., decides the condition. For example, a high unemployment rate can drastically reduce the demand for estate, while low-interest rates can gradually increase it. That’s why this market can’t be dependent on a single factor and keeping up with all the elements is integral.

The five essential factors discussed above, influence real estate markets in real-time. A single factor can’t be responsible to control the whole industry. That is why, it is necessary to have a deep knowledge of all circumstances, from understanding supply and demand dynamics to analyzing cycles, you can’t miss any point to make an accurate selection.